If you thought the revised Greek government fiscal deficit projection for 2009 was disastrous at 12.3% of GDP, fasten your seat belt and hold onto your hat. As awful as that figure was when Prime Minster George Papandreou revealed that the previous government in Athens had deliberately lied about the deficit so that Greece would be admitted into the Eurozone, in retrospect the powers that be in Brussels, joined by the IMF, wish to God that 12.3% was the number. Now, we learn, the actual deficit figures are even worse, though nobody can be certain at this point how bad they really are.

Eurostat, the statistical department of the EU, has released its own evaluation of Greece’s fiscal reality, and has concluded that, at a minimum, the actual deficit to GDP accrued by Athens in 2009 was 13.6% and might even be as high as 14.1%. Due to deliberate bookkeeping chicanery by previous Greek governments, apparently facilitated at least in some measure by the unique financial engineering of Goldman Sachs, the true state of Greek fiscal reality is hidden by a thick layer of artfully contrived opacity.

In the light of this latest revelation, courtesy of Eurostat, yields on Greek government bonds continue their upward climb. For example, yields on ten year Greek bonds now exceed 9%, nearly six hundred basis points higher than the equivalent bonds being offered by Germany. Clearly, the sovereign debt market is far from reassured by the latest version of the ever-changing Greek bailout package, which in its latest manifestation was cobbled together by the Euzozone countries and the IMF.

In response to the ever-worsening truth now emerging about how dire the Greek debt crisis really is, the ratings agencies are again weighing in with a downgrade of Greek sovereign debt. Moody’s has lowered its rating on Greece by another notch, and likely the other ratings agencies will soon weigh in. This will inevitably further expand the spread in bond yields, and only add to the complication of even a short-term bailout.

When Lehman Brothers collapsed in September of 2008, there was an immediate freeze in the global credit market, reflecting acute distrust by counterparties spooked by misleading financial representations by major investment firms, especially with regard to mortgage backed securities. The latest revelations concerning the Greek fiscal crisis point to a similar phenomenon that is increasingly likely. As the sovereign debt crisis currently afflicting Greece not only worsens but spreads to other countries with large deficit to GDP correlations, the risk of a Lehman Brothers type scenario with respect to the sovereign debt market becomes increasingly probable, with one important difference.

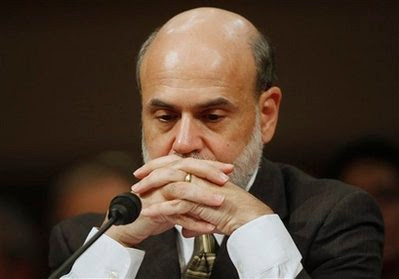

When Lehman Bothers collapsed and credit markets froze, sovereigns borrowed massively and bailed out their financial systems. However, if this time sovereigns are the actors frozen out of the credit market, who bails them out? Answer than one, Ben Bernanke and Timothy Geithner.