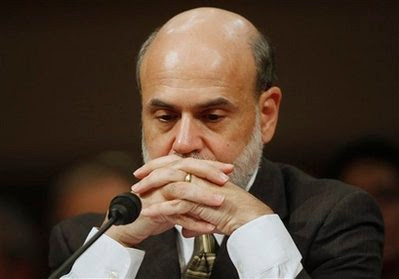

Alan Grayson is a Democratic Congressman representing Florida’s 8th congressional district. He was elected in 2008, having beaten the 4-term Republican incumbent. Despite his freshman status, Grayson is already developing a reputation as a fierce advocate for taxpayer interests in the wake of massive bailouts of the financial sector that have been orchestrated by the Treasury Department and Federal Reserve. Serving on the Financial Services Committee and subcommittee that deals with capital markets, the congressman, having been a successful entrepreneur, clearly knows how to read a balance sheet and ask relevant questions. Thus, the stage was set when the Florida congressman had the opportunity to question Fed Chairman Ben Bernanke when the latter appeared before Congress to present an update on the economic crisis gripping America and much of the world.

Congressman Grayson demanded details from Bernanke on a half trillion dollars in liquidity swaps to foreign central banks undertaken by the Federal Reserve, apparently under the radar and in the dead of night. Demonstrating that he and his staff had done their fact-checking, Grayson noted that in 2007 these swaps with overseas central banks were a mere $24 billion, but had swelled to a staggering $553 billion in 2008 with the onset of the Global Economic Crisis.

The exchange between Grayson and Bernanke appears almost Kafkaesque in its reality-defying character, conveyed in the following, as a clearly uncomfortable Fed Chairman provides a tortured explanation regarding this half trillion dollar transaction:

Bernanke: “Those are swaps that were done with foreign central banks…”

Grayson: “So who got the money?”

Bernanke: “Financial institutions in Europe and other countries…”

Grayson: “Which ones?”

Bernanke: “I don’t know.”

Grayson: “Half a trillion dollars and you don’t know who got the money?”

Bernanke: “Um, um, the loans go to the central banks and they then put them out to their institutions…”

Half a trillion dollars is a number so grandiose, it defies comprehension unless it is reduced to its ultimate simplicity. These credit swaps that exchanged American dollars for various foreign currencies were done without any consultation with elected officials, and amount to more than $1,800 for every man, woman and child residing in the United States. Under section 14 of the Federal Reserve Act, according to Chairman Bernanke, the Fed’s Open Market Committee (FOMC) can engage in swapping U.S. dollars with foreign central banks without any limitations, at any time, without any requirement for congressional scrutiny. In other words, “Congressman Grayson, why are you wasting my valuable time with these irrelevant questions,” Bernanke seemed to be implying through his frosty demeanour. Never mind that the Federal Reserve Act was originally passed in 1913, nearly a century ago.

“Is it safe to say that nobody in 1913 contemplated that a small little group of people would decide to hand out half a trillion dollars to foreigners,” Grayson pointed out. He raised as an example New Zealand, which received $9 billion from the Federal Reserve, an amount equal to $3,000 for every one of that nation’s citizens.

The congressman from Florida’s 8th district is to be commended for his focussed inquiries directed at the Fed Chairman, and steadfastness in the face of Bernanke’s evasiveness. More importantly, Grayson raises anew serious questions regarding the unlimited power placed in the hands of the Federal Reserve. The defenders of the Fed’s current position of fiscal omnipotence maintain that its independence from political influence must be preserved. However, the historical record, especially in the last 20 years, clearly shows that the Federal Reserve is influenced politically, either through the executive branch and the power of the President to reappoint the Fed Chairman, or through the large financial institutions on Wall Street, which have a level of access to Fed decision-making not available to any other category of citizens. More importantly, since the onset of the current financial and economic crisis, the Federal Reserve and its chairman have proven to be highly fallible, having made many errors in judgment, not the least being their original overly-optimistic pronouncements when the first tremors from the subprime meltdown arose.

Congressman Grayson’s penetrating inquiry serves as a reminder that the ultimate systemic risk to America’s financial system and economic superstructure stems from allowing a small, fallible clique to make speedy decisions involving incalculable sums of public money without any consultation with or checks and balances from the nation’s elected representatives. This is not only fiscal tyranny by any other name; it is a recipe for unintended and disastrous consequences.